The notary is a jurist with the task of public officer, who ascertains the free and informed consent of the parties. The notary also has the role of legal adviser. It therefore protects consent. The intervention of the notary is very important when purchasing an apartment in a divided co-ownership. A professional, he is a member of the “Chambre des notaires du Québec” (Québec Chamber of Notaries). In this capacity, the notary's mission is to receive, on behalf of his clients, the acts to which the parties must or want to have given the character of authenticity (such as a declaration of co-ownership).

The notary is a jurist with the task of public officer, who ascertains the free and informed consent of the parties. The notary also has the role of legal adviser. It therefore protects consent. The intervention of the notary is very important when purchasing an apartment in a divided co-ownership. A professional, he is a member of the “Chambre des notaires du Québec” (Québec Chamber of Notaries). In this capacity, the notary's mission is to receive, on behalf of his clients, the acts to which the parties must or want to have given the character of authenticity (such as a declaration of co-ownership).

Even though it is preferable that he should get involved at the outset of a transaction, this legal adviser usually gets involved after the signing of the offer to purchase or of the preliminary contract.

Mission of the notary

The notary, in his capacity of public officer:

Role of the notary

The preparation of a deed of sale in a divided co-ownership is much more complex than a deed of sale for a single family home. It implies a lot of work on his part and he should be knowledgeable in the specialized field of co-ownership Law.

He must review many legal documents, such as the declaration of co-ownership, the certificate of location, the statement of common expenses, and sometime, the minutes of the meetings of the co-owners and of the Board of Directors. He must also verify that the syndicate of co-ownership has subscribed insurance, and that its policy is in conformity with the declaration of co-ownership and with the Law. These verifications are essential, failing which the notary will be incapable to give you the necessary advice on the potential risks of the transaction.

His work requires the active participation of many other parties, such as the purchaser, the vendor, the hypothecary creditor and the Board of Directors. In certain cases, he must also communicate with the land surveyor and the damage insurance broker of the syndicate to obtain specific information.

The notary should participate from the outset in the purchase process. Thus, he will have the time to complete the necessary verifications allowing the purchaser to better understand the financial stakes of his purchase. Furthermore, the purchaser will also obtain real estate titles devoid of defects.

Mandate of the notary

One of the main tasks of a real estate notary is to search for what is called the "chain of title" to a property. Beyond this examination of the titles of the property, the notary will proceed to:

The review of the prior contract (the offer to purchase or the preliminary contract)

The notary must review carefully the prior contract, to ensure that all its terms and conditions have been satisfied. This review ensures that the deed of sale will reflect precisely the will of the parties.

The examination of the titles of the property

The notary has a lawful obligation of counselling both the buyer and the vendor. One of the components of the duty of counselling is the title examination. To ensure that the purchaser acquires a valid title in the property, the notary must verify that the vendor is the true owner of the property being sold, that he is capable of transferring a title exempt from any title defects, and that he has the right to sell the property.

To this end, the notary proceeds to the examination of the titles of the property. This operation consists, in essence, to examine the index of immoveables and to read the deeds registered against the immovable (in certain cases, one must go back to the preparation of the cadaster, as far back as 1866) and examine the cadastral plans and analyze the encumbrances that may affect, limit or depreciate the property (such as: hypothecs, servitudes, judgments and seizures). The certificate of location must also be reviewed carefully.

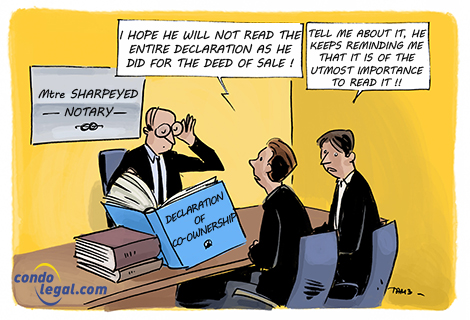

The review of the declaration of co-ownership

To satisfy his obligation of information to the purchaser, the notary must give you explanations on your impending legal and financial obligations as a co-owner. To this end , he will analyze the declaration of co-ownership and its amendments (if any) and request from the Board of Directors the documents modifying the By-Law of the immovable which have not been registered in the Land Register, and the minutes of the meetings of the co-owners at which these amendments have been adopted.

The analysis of certain documents relating to the immovable and the syndicate

The notary proceeds to carry out verifications of the targeted co-ownership. In order to do so, he will send a questionnaire to the Directors of the syndicate of co-owners. This questionnaire includes, more particularly, a request for a statement of the common expenses related to the targeted unit, and a copy of the insurance policy of the syndicate. When the notary receives this information from the syndicate, he will review it and ask for details or corrections, if necessary.

The drafting of the deed of sale

The notary drafts the deed of sale, the content of which must be in conformity with the offer to purchase or the preliminary contract. Furthermore, before the execution of the deed of sale, he will verify if the real-estate taxes and common expenses owing have been paid. It is at the occasion of this exercise that he will prepare the statement of disbursements.

This document deals with the partition (adjustments) between the purchaser and vendor of the cost of the encumbrances affecting the immovable (common expenses, municipal and school taxes etc.). This calculation will take into account the amounts paid or unpaid by the vendor, to determine the amounts owing to and by each party.

The signing of the deed of sale

Finally, the notary receives the parties before him to sign the deed of sale after receiving and depositing the necessary funds in his trust account. At the signing of the deed of sale, the purchaser becomes the owner. In all cases, the notary must register the deed of sale and verify that it has been indexed and that there are no adverse entries (such as legal hypothecs) in the Land Register before remitting the funds to the vendor.

Allocation (Adjusments)

During the transaction, the notary also makes the ajustements for the payment of common expenses (condo fees),and property taxes. As for the common expenses, the notary must, before signing the deed of sale, ask the board of directors or the manager for a certificate that specifies the following information:

As for municipal and school taxes, it will be necessary to take into account the sums that the seller has paid before the transaction and whose payment benefits the buyer according to the date agreed between the parties for the transfer of the private portion. The same applies to sums that have not yet been invoiced to the seller, but for which he is responsible for payment. For example, if the sale of the apartment was completed during the year, but the municipal tax bill is still to come, the seller will have to give the buyer the portion corresponding to the time of year when he owned the apartment.

Note that it is possible for a newly built co-ownership that the authorities have not yet assessed your unit or issued the property tax bills (this step takes a few months).

WHAT YOU SHOULD KNOW! The notary can act as a legal advisor. He can, for example, draft an offer to purchase perfectly adapted to the property that will reflect the will of the parties. He may also recommend useful examinations to be carried out before the purchase, and explain the legal structure and the day to day operation of a divided co-ownership.

WHAT YOU SHOULD KNOW! The notary can act as a legal advisor. He can, for example, draft an offer to purchase perfectly adapted to the property that will reflect the will of the parties. He may also recommend useful examinations to be carried out before the purchase, and explain the legal structure and the day to day operation of a divided co-ownership.

WHAT TO KEEP IN MIND: It is in the best interest of the parties (purchaser and vendor) in a transaction to consult a notary, from the outset of the process leading ultimately to a sale. He is able to review, during the period of time allocated to withdraw from your purchase, the various documents remitted by the vendor and the syndicate of co-owners. To benefit from a period of time to withdraw, you should insert a suspensive condition in the offer to purchase.

WHAT TO KEEP IN MIND: It is in the best interest of the parties (purchaser and vendor) in a transaction to consult a notary, from the outset of the process leading ultimately to a sale. He is able to review, during the period of time allocated to withdraw from your purchase, the various documents remitted by the vendor and the syndicate of co-owners. To benefit from a period of time to withdraw, you should insert a suspensive condition in the offer to purchase.

WARNING! The purchase of an apartment in a co-ownership necessitates a high degree of knowledge on the part of the notary of the rules governing this legal regime. In this regard,the “Fonds d’assurance responsabilité de la Chambre des notaires du Québec” (the Québec Liability Insurance Fund of the Chamber of Notaries ) has stated “In the last few years, claims related to co-ownership have become an important concern, not only in their number, but also for their cost ”. This citation is drawn from a bulletin sent to the members of the Fund in 2012. It is therefore crucial to retain the services of a competent notary, recognized as an expert in divided co-ownership Law.

WARNING! The purchase of an apartment in a co-ownership necessitates a high degree of knowledge on the part of the notary of the rules governing this legal regime. In this regard,the “Fonds d’assurance responsabilité de la Chambre des notaires du Québec” (the Québec Liability Insurance Fund of the Chamber of Notaries ) has stated “In the last few years, claims related to co-ownership have become an important concern, not only in their number, but also for their cost ”. This citation is drawn from a bulletin sent to the members of the Fund in 2012. It is therefore crucial to retain the services of a competent notary, recognized as an expert in divided co-ownership Law.