Date published: 13/11/2024

Insurance deductible: What proof must the Syndicate provide to obtain reimbursement?

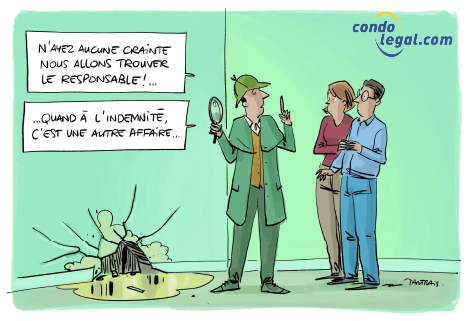

A recent decision by the Court of Québec provides important clarifications for co-ownership syndicates seeking to recover insurance deductibles from co-owners in the event of a claim. In this ruling, the Court dismissed a syndicate’s request for a co-owner to reimburse a deductible of $50,014.13 following water damage that occurred in their unit. This decision sheds light on the complexities of proving liability in such cases and highlights several recurring issues regarding co-owner responsibility and the burden of proof that falls on the syndicate in disputes related to material damages in co-ownership.

A recent decision by the Court of Québec provides important clarifications for co-ownership syndicates seeking to recover insurance deductibles from co-owners in the event of a claim. In this ruling, the Court dismissed a syndicate’s request for a co-owner to reimburse a deductible of $50,014.13 following water damage that occurred in their unit. This decision sheds light on the complexities of proving liability in such cases and highlights several recurring issues regarding co-owner responsibility and the burden of proof that falls on the syndicate in disputes related to material damages in co-ownership.

Case background:

A newly-arrived co-owner hires service providers to carry out minor work in their unit before moving in. While one of these service providers is working, including removing existing wallpaper, a sprinkler is triggered, causing significant water damage both in the co-owner’s unit and in the building’s common portions.

The syndicate, after covering the deductible amount for its insurance claim, seeks reimbursement from the co-owner, alleging that they are responsible due to their service provider’s fault. The syndicate relies on a provision in the declaration of co-ownership, which reads: “Each co-owner remains liable to other co-owners and the syndicate for the damages caused by their own fault or negligence, or that of their subordinates, or by any property for which they are legally responsible.”

Key points of the judgment:

- Lack of direct proof of fault: The Court first noted that the syndicate did not provide direct evidence, nor an expert assessment, establishing that the sprinkler’s activation was caused by the use of wallpaper stripping equipment. They had to proceed based on presumption. However, for a presumption of liability to be accepted, the syndicate needed to demonstrate through serious, precise, and consistent facts that the use of this equipment indeed caused the incident. The judge added that presumptive evidence cannot be purely speculative; it must be supported by well-established facts that directly and necessarily lead to the sought conclusion. The absence of such precise and consistent facts was decisive in rejecting the claim.

- Liability regarding the relationship between the co-owner and service provider: The Court also examined the nature of the relationship between the co-owner and the service provider hired to perform these occasional tasks. The service provider was an independent worker, with no subordinate relationship to the co-owner, and their relationship was based on a contract for service. The Court concluded that this individual was not an “subordinate” in the sense of article 1463 of the Civil Code of Quebec but rather an independent contractor. Therefore, the co-owner could not be held liable for the acts of this service provider.

- Application of Article 1074.2 of the Civil Code of Quebec and Provisions of the Declaration of co-ownership: As the incident occurred , the judge examined article 1074.2 C.c.Q. (2nd version) and determined that the provision of the declaration of co-ownership on which the syndicate’s claim was based partially deviated from the first paragraph of this article. Therefore, this provision (clause) in the declaration of co-ownership is deemed unwritten. The judge concluded that the syndicate needed to prove that the co-owner had committed a fault causing the damage or that the damage resulted from the property or fault of a person for whom the co-owner is legally responsible in this case, the service provider hired to perform the work on the day of the incident. Failing to make such a demonstration, the syndicate did not succeed in its claim.

Our recommendations:

This judgment offers several practical lessons for co-ownership syndicates wishing to ensure rigorous management of incidents involving co-owners and to protect against similar situations:

- Implement a policy for managing work in private portions: The syndicate should formalize a clear, written procedure for all co-owners wishing to carry out work in their units, specifying which types of work require approval, documents to be provided (plans, quotes, insurance), and mandatory verifications.

- Engage an independent claims adjuster: In the event of a claim, it is recommended that the co-ownership syndicate engage an independent claims adjuster, specifically appointed to represent the syndicate and intervene when the damage amount is less than the deductible. This specialist is responsible for investigating the causes of the claim, assessing the extent of the damages, and determining the civil liability of co-owners or third parties involved. The adjuster, who holds a claims adjustment certificate issued by the Autorité des marchés financiers and is a member of the Chambre de l’assurance de dommages, provides a decisive analysis to establish the cause of the claim and the resulting liability.

- Regulate service provider interventions in private and common portions: To avoid potential disputes, the syndicate should clarify in its internal regulations the procedures that co-owners must follow when hiring service providers in their units, requiring, for example, licenses and insurance and prohibiting certain interventions near sensitive systems, such as sprinklers.

Conclusion: This judgment highlights the importance for co-ownership syndicates to follow strict procedures and rigorously document interventions in private portions. Proof of fault is essential for recovering deductibles from co-owners, and proactive, regulated management can help minimize the risk of future disputes.

Reference: Le Nouvel Europa syndicat de la copropriété c. Minneci (2024 QCCQ 5903)

Me Yves Joli-Coeur, Emeritus Lawyer

Dunton Rainville

3055 Boulevard Saint-Martin O

Bureau 610

Laval, QC H7T 0J3

Tél. : (450) 686-8683

Email : [email protected]