14/12/2024

Two recent rulings by the Court of Québec underscore the significant difficulties syndicates encounter when attempting to recover insurance deductibles for damages caused by tenants, highlighting not only the legislative and practical shortcomings in claims management but also the broader implications of these challenges, which persist despite amendments to article 1074.2…...

30/11/2024

A defective water heater belonging to a co-owner caused a water leak, damaging the hardwood floor in their apartment. Concerned about maintaining the state of the private portions, the syndicate decided to replace the hardwood floor and covered the costs since the damages were below the insurance deductible. The co-owner's…...

13/11/2024

A recent decision by the Court of Québec provides important clarifications for co-ownership syndicates seeking to recover insurance deductibles from co-owners in the event of a claim. In this ruling, the Court dismissed a syndicate’s request for a co-owner to reimburse a deductible of $50,014.13 following water damage that occurred…...

21/09/2024

When purchasing an apartment in a high-rise building, the buyer automatically becomes a co-owner in a vertical co-ownership, where the units are stacked on top of each other. However, when acquiring a house (detached, townhouse or semi-detached) located on a shared piece of land with other houses, it typically falls under horizontal co-ownership., where…...

01/07/2024

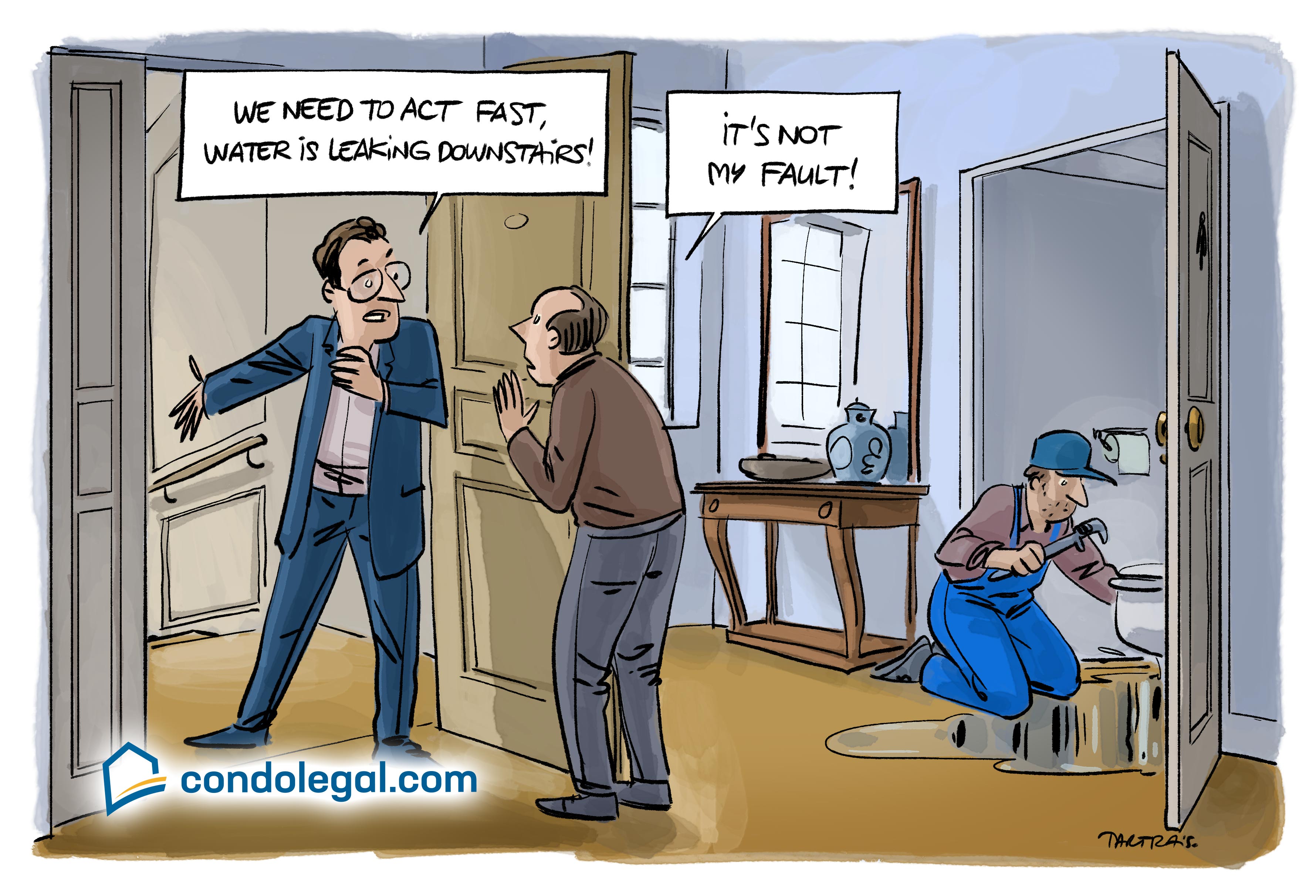

A bathtub or a washing machine that overflows into the apartment below, a water heater that conks out and spills down six floors: losses involving the civil liability of a co-owner are many co-ownerships. And they are expensive! This is why the amount of insurance premiums and deductibles have increased significantly in…...

23/06/2024

Declarations of co-ownership generally include a clause that holds each co-owner responsible (towards the other co-owners and the syndicate) for damages caused by their fault or negligence and by the fact of a property for which they are legally responsible. In the case Syndicat de la copropriété 650 Marcel-Laurin c. Neng (2024…...

26/05/2024

In the event of a loss, it is imperative for the insured, whether a co-owner or a director of a co-ownership syndicate, to report the incident to their insurer as soon as possible. This declaration generally triggers the designation of a claims adjuster by the insurer. This professional is responsible…...

25/05/2024

Most insurance policies include deductibles, with amounts varying based on the insured risk. For example, the deductible for water damage is generally higher than that for fires. The purpose of the deductible is to make the insured responsible by having them cover part of the repair costs for damages caused by…...

20/05/2024

With the increasing presence of tenants in divided co-ownership buildings, it is essential for all stakeholders to fully understand the issues related to insurance coverage. Unlike in other countries, Quebec law does not require tenants to purchase “home insurance”, which would cover their belongings and civil liability in the event…...

10/05/2024

A co-ownership may face a multitude of risks such as fires, water damages, break-ins and acts of vandalism. In the event of a loss, the co-ownership's insurance plays an essential role in ensuring its sustainability and so, by covering not only the immovable itself but also the civil liability of the syndicate of…...

27/04/2024

The law obliges syndicates of co-owners to insure their immovable; the majority of declarations of co-ownerships also have such requirement. This can be explained by the syndicate's main objective which consists to ensure the preservation of the immovable and its longevity; this is why the legislator has given to the syndicate an insurable interest and has made it…...

01/01/2024

Dans cette capsule vidéo, l’avocat émérite Yves Joli-Coeur aborde un sujet essentiel pour toute copropriété : les recours du syndicat contre un copropriétaire responsable d’un sinistre. Il souligne que lorsqu’un sinistre survient dans une copropriété, le copropriétaire de l’unité d’où provient le sinistre n’est pas systématiquement tenu responsable. La responsabilité…...

01/01/2024

Dans cette capsule vidéo, l’avocat émérite Yves Joli-Coeur aborde un sujet crucial pour tout administrateur et copropriétaire: la récupération de la franchise lorsqu’un sinistre est généré par ce dernier dans l’immeuble. Il rappelle que les sinistres impliquant la responsabilité civile d’un copropriétaire sont nombreux et peuvent coûter cher. Que ce soit…...

23/02/2021

23 février 2021 — Un récent sondage commandé par le Bureau d’assurance du Canada (BAC) a révélé plusieurs données inquiétantes. Parmi elles, on apprend qu’un copropriétaire sur cinq (19 %) ignore que sa copropriété est protégée par deux contrats d’assurance. Cela confirme une méconnaissance pour la chose par plusieurs copropriétaires,…...

09/08/2022

Question: I am a co-owner. Can the syndicate of co-owners claim the amount of the deductible for the insurance if I am responsible for the water damage?...